How Much Gold Should You Have in Your Retirement Portfolio?

When building a strong, diversified retirement plan, most investors focus on traditional assets like stocks, bonds, and mutual funds. But in today’s uncertain economy, more retirees are turning to physical gold as a way to protect their savings from inflation, market crashes, and currency risk.

So how much gold should you have in your retirement portfolio? The answer depends on your goals, risk tolerance, and investment timeline — but most experts agree that a strategic allocation to gold can significantly strengthen your financial foundation.

🟡 Why Include Gold in Your Retirement Portfolio?

Gold has long been considered a safe-haven asset — a reliable store of value during economic downturns, inflationary periods, and stock market volatility.

✅ Benefits of Adding Gold to Retirement:

-

Inflation hedge: Gold typically rises in value as the dollar weakens

-

Portfolio diversification: Gold often moves independently of stocks and bonds

-

Tangible asset: Unlike paper assets, gold is physical and finite

-

Global demand: Gold remains a valuable commodity across all markets and cultures

By investing in gold — especially through a Gold IRA — you can shield part of your retirement savings from systemic risk while maintaining tax-advantaged growth.

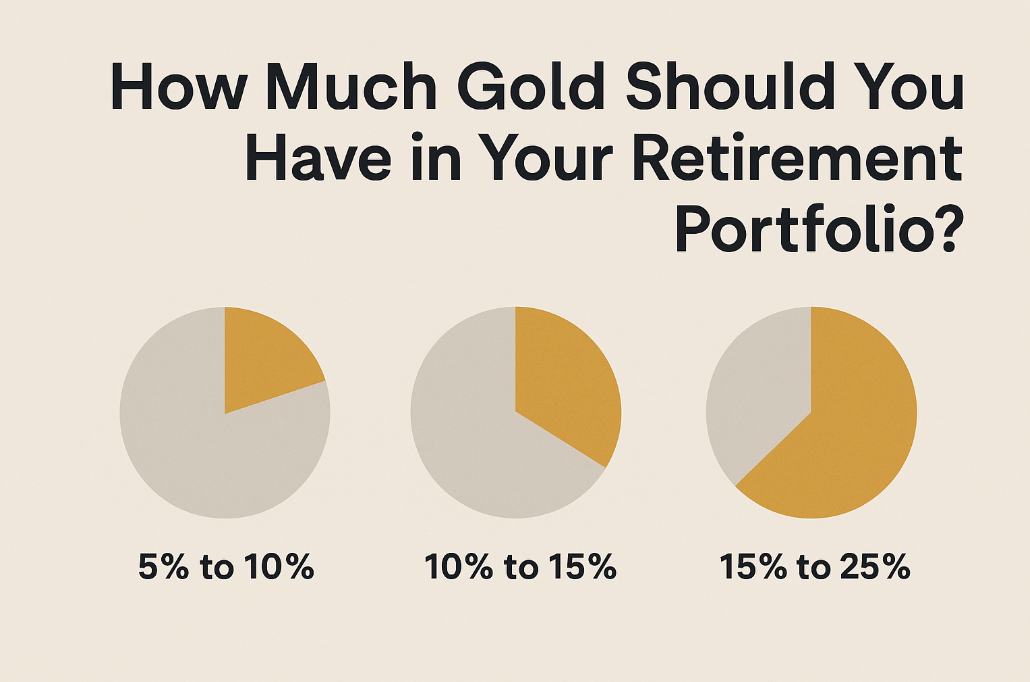

📊 So, How Much Gold Should You Own?

While there’s no one-size-fits-all answer, here are general guidelines based on expert recommendations and investor profiles:

🔹 Conservative Allocation (5–10%)

Ideal for traditional investors who want modest diversification without overexposure.

-

Helps balance a 60/40 stock-to-bond portfolio

-

Minimizes volatility while preserving liquidity

🔹 Moderate Allocation (10–15%)

Best for investors concerned about long-term inflation and market instability.

-

Enhances diversification

-

Improves downside protection during recessions or currency declines

🔹 Aggressive Allocation (15–25%)

Used by investors expecting major financial disruption or currency devaluation.

-

Larger hedge against systemic risk

-

Useful for long-term wealth preservation (especially with a global outlook)

📌 Most financial advisors recommend keeping gold between 5% and 15% of your total portfolio.

This range offers strong protection without sacrificing overall growth potential.

⚖️ Factors That Affect How Much Gold You Should Hold

1. Your Risk Tolerance

-

Conservative investors may prefer lower gold exposure

-

Risk-averse investors closer to retirement may want more

2. Market Conditions

-

In times of high inflation or political instability, increasing gold allocation may be wise

3. Time Horizon

-

The longer until retirement, the more room you have to balance gold with growth assets

4. Existing Diversification

-

If your portfolio is heavily weighted in tech or equities, gold can counterbalance volatility

🏦 How to Hold Gold in Retirement

The best way to hold gold in a retirement account is through a self-directed Gold IRA. This allows you to:

-

Own physical gold (not just gold stocks or ETFs)

-

Enjoy tax-deferred or tax-free growth (Traditional or Roth IRA)

-

Choose IRS-approved gold coins and bars stored in secure depositories

You can also diversify further by including silver, platinum, or palladium in your precious metals IRA.

❗Common Mistakes to Avoid

-

Over-concentrating in gold: Too much gold can limit portfolio growth

-

Holding collectible coins: These may not qualify for an IRA and can carry high premiums

-

Not using a reputable custodian: Always work with a trusted Gold IRA provider

-

Storing gold at home in an IRA: This violates IRS rules and can trigger penalties

🧠 Final Thoughts

Adding gold to your retirement portfolio is a time-tested way to hedge against inflation, diversify your assets, and preserve long-term wealth. While every investor’s situation is different, allocating 5% to 15% of your retirement portfolio to gold is a balanced, strategic choice.

Whether you’re just getting started or ready to rebalance your investments, a Gold IRA can help you build a more secure financial future — backed by the lasting value of physical gold.

💬 Ready to Diversify with Gold?

Check out our latest guide on the Best Gold IRA Companies of 2025 and discover trusted custodians who can help you protect your retirement with physical gold.