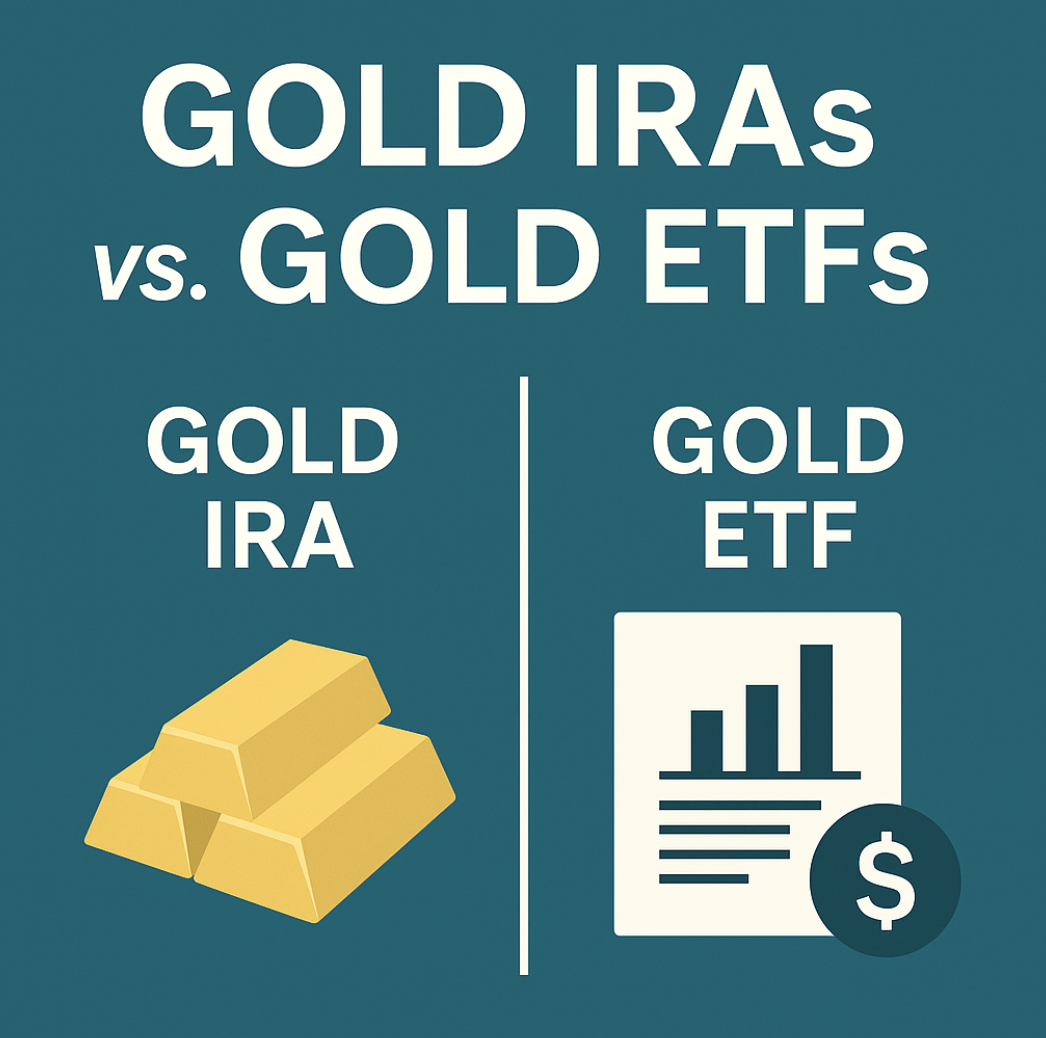

Gold IRAs vs. Gold ETFs: What’s the Difference?

Gold IRAs vs. Gold ETFs: What’s the Difference?

If you’re looking to diversify your portfolio and protect your retirement savings, gold is a timeless choice. But when it comes to investing in gold, one important decision stands out:

Should you invest in a Gold IRA or a Gold ETF?

Both options provide exposure to gold, but they serve very different purposes. In this article, we’ll break down the key differences between Gold IRAs vs. Gold ETFs, including ownership, costs, liquidity, tax implications, and which might be best for your financial goals.

🟡 What Is a Gold IRA?

A Gold IRA is a type of self-directed individual retirement account that allows you to invest in physical gold and other IRS-approved precious metals (like silver, platinum, and palladium).

Your assets are held in an IRS-approved depository and managed by a qualified custodian.

✅ Key Features:

-

Physical ownership of gold (coins or bullion)

-

Long-term, tax-advantaged retirement savings

-

Must meet strict IRS rules for purity and storage

-

Not tied to the performance of paper markets

📈 What Is a Gold ETF?

A Gold ETF (Exchange-Traded Fund) is a market-traded fund that tracks the price of gold. It’s a paper asset — you don’t own actual gold, just shares that represent exposure to the price of gold.

Popular Gold ETFs include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU).

✅ Key Features:

-

Traded on stock exchanges (just like stocks)

-

Easy to buy/sell through a brokerage account

-

No physical metal — you own shares backed by gold (in theory)

-

Better for short-term exposure or portfolio hedging

⚖️ Gold IRA vs. Gold ETF: Side-by-Side Comparison

| Feature | Gold IRA | Gold ETF |

|---|---|---|

| Asset Type | Physical gold (coins/bullion) | Paper investment tracking gold’s price |

| Ownership | You own real, tangible gold | You own shares of a fund |

| Storage | Held in IRS-approved vaults | No personal storage required |

| Liquidity | Less liquid; longer to sell | Highly liquid (traded like a stock) |

| Tax Treatment | Tax-deferred or tax-free (IRA rules apply) | Taxed like stocks (capital gains) |

| Fees | Storage, custodian, setup fees | Low expense ratios, brokerage commissions |

| Use Case | Long-term retirement strategy | Short- to mid-term market exposure |

| Risk Profile | Less market volatility, inflation hedge | Tied to market sentiment and price swings |

✅ Pros and Cons of a Gold IRA

Pros:

-

Tangible asset ownership

-

Excellent long-term hedge against inflation and economic crises

-

Retirement tax benefits (Traditional or Roth)

-

Diversification from paper-based investments

Cons:

-

Higher upfront costs and ongoing fees

-

Less liquid than stocks or ETFs

-

Requires a custodian and IRS-approved storage

✅ Pros and Cons of a Gold ETF

Pros:

-

Easy to buy/sell anytime during trading hours

-

Low cost (expense ratios usually under 0.50%)

-

No need to deal with physical storage or security

-

Great for active investors or short-term hedging

Cons:

-

No actual gold ownership

-

No IRA tax benefits unless held in a retirement account

-

Exposed to market volatility and counterparty risk

-

Can’t be used as a true store of value in emergencies

🔍 Which Is Right for You?

| Choose a Gold IRA if you want: |

|---|

| Long-term wealth preservation |

| Physical gold ownership |

| Retirement tax advantages |

| Protection from economic downturns |

| Choose a Gold ETF if you want: |

|---|

| Low-cost, short-term gold exposure |

| Easy trading and portfolio hedging |

| Minimal effort and no storage |

🧠 Can You Own Both?

Yes! Many smart investors own both Gold IRAs and Gold ETFs — using Gold IRAs for long-term retirement stability and Gold ETFs for more agile portfolio moves.

This dual strategy gives you both stability and flexibility in your overall gold exposure.

✅ Final Thoughts

When comparing Gold IRAs vs. Gold ETFs, the right choice comes down to your goals:

-

If you want to physically protect your retirement savings, a Gold IRA is the better option.

-

If you want to trade gold like a stock with minimal fees and easy access, Gold ETFs may fit the bill.

Either way, gold remains a powerful way to hedge against inflation and preserve your purchasing power — especially in uncertain economic times.

💬 Ready to Open a Gold IRA?

Check out our latest guide: [Best Gold IRA Companies of 2025] — and find a trusted custodian to start protecting your retirement with real, physical gold.